According to the answers obtained, approximately one third of the specialists in the field are of the opinion that in 2021 we can expect increases of up to 10% in house and land prices, respectively decreases in the segment of commercial / office spaces.

"The real estate market remains one of the most dynamic industries in the economy - being a major vector of development, especially for emerging economies, so that periods of turbulence generate great opportunities in this area. 2020 was a year with great changes in society and economy, a year in which important industries were deeply destabilized, and yet the real estate market proved to remain stable and as dynamic as in 2019. About 2021 we believe it will be a year with a developing residential market, with a possible correction in the commercial and office market, brought by the compression of street retail and labor, but with an increase of the construction land segment ”, said Răzvan Cuc, President of RE / MAX Romania.

Forecasts for 2021 - House and land prices may rise, apartments may stagnate

According to the real estate specialists who participated in the RE / MAX study, the houses will remain in the top of the Romanians' residential preferences, as a result of which the majority predicts an increase or at most a stagnation of prices in this segment. Thus, over a third (35%) of respondents believe that house prices will increase by up to 10%, while 29% predict their stagnation. The decrease is predicted by only 20% of study participants.

Increases of up to 10% are also mentioned for the land segment, with 33% of respondents estimating that they will be a valuable investment in 2021. The forecast reflects the preferences of buyers to move away from the urban bustle and build a home with more personal space.

On the other hand, specialists have divided opinions in the case of apartments. If most (32%) predict that their prices will stagnate in 2021, a percentage of 24% believe that the segment will experience price declines, and another 24% say that there will be increases in this regard. Decreases will also be registered in the case of commercial / office spaces, a majority of 30% expecting prices reduced by more than 10% in this segment. This trend reflects the shift of business to the online environment, as well as the new work from home norm.

The changes brought by the pandemic were also seen in the demand, respectively the prices on the rent segment. Thus, the participants in the survey consider that even in 2021, rental prices will stagnate (35%) or even decrease by up to 10%, 26% of them say. For the same reasons, more than a third (32%) believe that rental prices on the office market will fall by up to 10% or more than a tenth (32%).

The main factors that influenced the real estate market in 2020

The most important challenge in 2020, mentioned by a 46% majority, was obviously the COVID-19 pandemic. On the one hand, restrictions and social distancing have hampered the activity of real estate agents, and on the other hand, the social context has brought with it some concern about possible declining incomes. At the same time, in the context of high unemployment and the relocation of faculties to the virtual environment, there has been a decrease in rental prices in large cities.

Other representative changes for this period, as direct effects of the pandemic, were the increase of interest for the houses and land segment, a factor chosen by 14% of the study participants, respectively the increase of property prices, an observation made by 10% of them.

In comparison, in 2019 the first factor that influenced the market, with a large percentage difference from the rest, was the increase in property prices, and in 2018 the oscillation of the ROBOR index, which is decreasing.

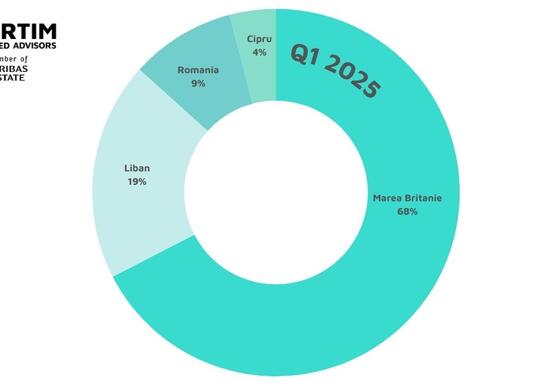

The real estate market in Europe, the main changes and trends

According to studies conducted at European level, one of the main changes observed was the steady decline in investment, which reached values close to those of 2014, in the context in which in the last six years there has been an increase.

Banks are still willing to provide financing to customers interested in real estate transactions, but are skeptical about financing developers. Exception f ac Romania and the Czech Republic, where funding is still granted at a moderate level.

Most European countries expect house prices to rise in the next two years, although they have stagnated or even fallen recently. In the last 10 years, house prices have increased by 25% in Europe, and rental prices by about 14.2%.

The RE / MAX & Veridio study was attended by over 250 respondents - real estate specialists - who work in 34 cities in the country. Most work in the field as real estate agents or real estate agency owners and fall into the 20-40 age segments.

For the full content of the study go to: https: //hubs.ly/H0GlqNH0